Michigan’s 10th district, north of Detroit is very swingy with an R+6 partisan lean. Gov. Gretchen Whitmer (D) won it by 7 points, Trump won by 1 point and Republican John James beat conservative Democrat Carl Marlinga by a fraction of a point— one of the tightest races in the country:

- John James- 159,202 (48.80%)

- Carl Marlinga- 157,602 (48.31)

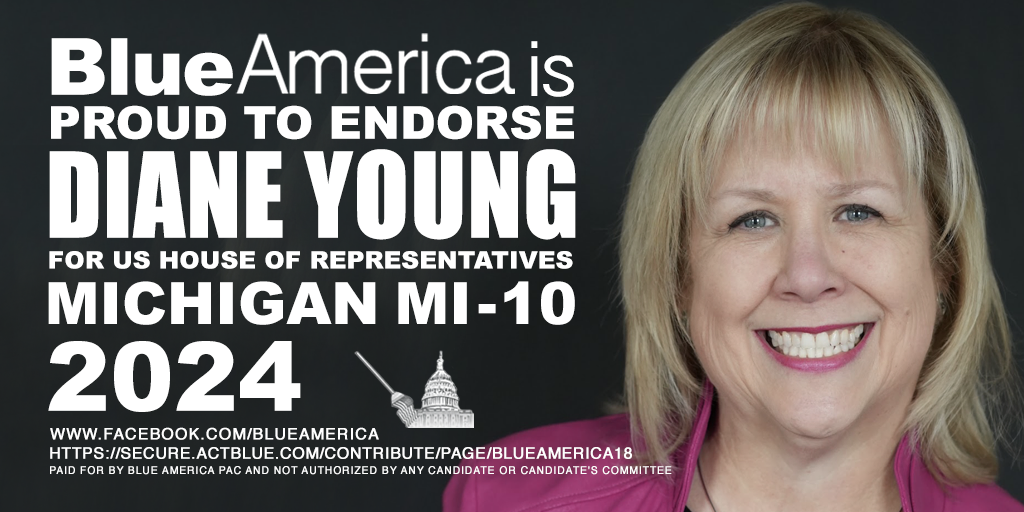

We think that one key to winning there is a strong, progressive female candidate, especially against James, who has stated he’s “100% against abortion,” against gun safety legislation “under any circumstances” and “2,000% for Trump.”

The antidote to John James: Diane Young, who we officially endorsed today. She’s a top financial planner and author of Owning your financial success: a savvy woman’s guide to financial empowerment. As a form of introduction, we asked her to write a short essay about how we need to deal with Social Security going forward.

Please consider contributing to her campaign here.

Shoring Up Social Security For Future Generations

-by Diane Young

As a fiduciary financial planner for over 30 years, I see firsthand how reckless policy-making in Washington impacts the average working family. And the worst part about it is that most working class people have no idea how they are being taken advantage of. As a member of Congress, I would advocate to change tax policy so billionaires and big corporations pay their fair share.

Let me do a deep dive into Social Security, and bear with me while I do a bit of history first so we can have some context to this complex issue before discussing some solutions to securing social security for generations to come. In my opinion, we are in a perfect storm– we have an aging population that is living longer, fewer workers paying into the system in relation to retirees, and a funding system that allows the rich and powerful to get creative and avoid paying into the system. We must make fixes now or this program could implode.

Social Security is the cornerstone of most peoples’ retirement plans and ensuring that it is adequately funded for future generations is imperative. Most people don’t understand that Social Security is an insurance program, not a savings program. In fact, the official name of Social Security is the Old Age, Survivors, and Disability Insurance program. That means some folks will live to reap a retirement benefit, and some may not. But their beneficiaries like a spouse or dependent children may receive a benefit, providing a safety net for millions of Americans in their greatest time of need.

The Social Security program came out of the depression when about 40% of our elderly were living in poverty and we as a society said, never again. We would ensure that our seniors had at least some form of basic income in their old age. Although the poverty rate of our elderly living today is down to around 10%, it is still too high in my opinion, which is why we need to continue to strengthen this program.

Social Security is funded by a payroll tax on wages. In 1950, there were approximately 16 workers for every beneficiary. Since then, that ratio of worker to beneficiary has dropped to a little over two workers for every beneficiary. When Social Security was first introduced, the average life expectancy hovered around 65, so it was never intended to be a benefit that would last for decades for millions more people. Now, of course, our average life expectancy is in the mid-to-late 70’s, and our fastest growing segment of society are people living over the age of 100. My grandfather lived to 104, and lived in his own home until his passing. My father passed away a few years ago at the age of 94. So, at first glance, the common call to increase the full retirement age from 67 to age 70 seems like a reasonable step. But one has to dig a little deeper to see that longer healthy lifespans are not being equally shared across economic classes. Many blue collar workers and women are forced to take their benefits at age 62 due to health concerns or because they are dropping out of the workforce to care for a family member. For them, increasing the retirement age to 70 would significantly decrease the benefit they receive if they started their benefit early. According to the Center for Retirement Research, most blue collar workers live about five years less than white collar workers. Republicans, like my opponent John James and the other members of the right wing Republican Study Group, have repeatedly called to lift the full retirement age to 70. This would directly impact thousands of the blue collar workers in Mr. James’ district.

How Social Security is Calculated

Social Security is funded by payroll taxes. The employee pays 6.2% of their wages into the program and their employer pays 6.2%. Currently, the amount of annual earnings that can be taxed is capped at $168,000. So a worker making the national average income of $54,000 annually is paying the full 6.2% into Social Security while someone making $500,000 is only paying about 2% of their wages into Social Security.

Your benefit is calculated using your top 35 years of earnings. That’s great because many of us have periods of good work years and bad years. For example, I started working at 16 at McDonalds— and yes, those years count! From an income perspective, I had some terrible years while going to school, followed by some great years working in the corporate world, followed again by some challenging years while I started my own company, followed by better years as I grew my business. I will easily work 45 years by the time I file for Social Security. They will take my highest 35 years, adjust them for inflation and calculate my Full Retirement Benefit– which is what I would receive when I turn 67. If I take my check earlier, it will be reduced for every month I take it early. If we raise the full retirement age to 70, it will reduce how much I can take at age 62 significantly. Increasing the full-benefit age to 70 for many people, especially blue collar workers and women, will be devastating to their financial security as they age. Once you start taking social security, it locks in your benefit calculation for life. So even future inflation adjustments will be based on that lower benefit amount.

Pass-through companies get creative

One area that rarely gets discussed is how business owners pay into social security. Most businesses are set up as pass-through entities, meaning that after wages and expenses, remaining funds flow through to the business owner’s personal tax return and are taxed as ordinary income. There is no Social Security tax on that pass-through amount. Now, most business owners are supposed to take “Reasonable Compensation,” but they are given a lot of discretion to determine what that number is, and since the rate of audits amongst business tax returns is next to zero, there is little enforcement of what business owners are claiming as reasonable compensation. Because these business tax returns can be very complex, they require specialists to audit them, which the IRS has a hard time recruiting. One fix is to fund the IRS adequately and require a minimum audit rate of these types of businesses. It only takes one person at the country club to get audited to scare more people into compliance.

There is a reason that Republicans like John James, my opponent, are shouting to “Defund the IRS.” They don’t want their rich pals to get audited and have to pay into our social programs.

Raising the maximum amount taxed

In 2024, the maximum wage taxed for social security is $168,000. In any given year, only 6% of wage earners exceed this amount, so raising or uncapping that amount would impact relatively few individuals, yet it would go a long way to strengthening Social Security for generations to come.

Keep in mind that many millionaires support raising the threshold on this tax. They understand how important Social Security is to our country.

Means testing benefits

One option that is being floated is “means testing” your benefit. If you are rich enough, do you really need that Social Security check? Probably not, but the one great thing about Social Security is it is equal to all, based on earnings and years of work history. We wouldn’t want to create resentment in our society. However, we could make it so people could voluntarily suspend their benefits or decline to take their benefits. Currently, there is no mechanism for you to permanently refuse to take your check. In fact, at age 70, they will start sending you a check whether you want it or not. Of course, there is nothing preventing folks from giving away their money to charities. In fact, I have one wealthy client who purposely lives his life on what the federal poverty income is, giving away the rest of his income every year. He is truly a wonderful soul!

Taxing Social Security Benefits

Many of my clients are shocked to learn that a portion of their social security benefits are taxed, depending on how much income they earn in retirement. For an individual, once you have $25,000 in earnings in retirement you may have to pay income tax on 50% of your benefits. That jumps to 85% of your benefits once you earn $34,000 annually. Prior to Ronald Reagan, Social Security benefits were not taxed. And when benefit taxation was first introduced In 1984, only 10% of social security beneficiaries were taxed– now the rate of retirees getting taxed is over 50%. If we indexed the amount subject to taxation, we would provide significant relief to average retirees. Although the money collected does go back into the Social Security fund, it is an insidious tax on working class people, at the same time wealthy businesses can be creative with their income and avoid paying into the system.

Many retirees won’t find out about this tax until they have to start withdrawing money from their retirement accounts, which is now over the age of 72, soon to jump to 75. These distributions will often throw them into a higher tax bracket, adding to what they have to pay tax on their Social Security benefits.

Wealthier clients can often do some advance tax planning to help “manage the bracket” as we say in the business, but most average workers don’t have access to these financial planning techniques.

“But I should be able to invest my own money!”

This is a common complaint I hear about the money people have to put into Social Security. They think that if they wisely invested the money deducted from their paychecks for Social Security taxes, they would have more money than the benefits they will get from Social Security. First, since very few people are good at investing money consistently, that probably wouldn’t happen. Second, this doesn’t take into account that your family would have to live off of that savings if you died prematurely or were disabled. If a devastating event happened early in your career, you would most likely not have saved that much money and your family could potentially be destitute.

To help my clients understand this, I have them log into your Social Security Account at SSA.gov to review their statement. On the portal, all your earnings will be listed as well as how much you have put into the program and your employer’s contribution. Add those two numbers together and divide by the monthly amount you will receive at retirement. That will give you how many months you have to live to “break even.” Most of my clients are shocked that they only have to live 8-10 years to break even. One of the biggest mistakes my clients make is underestimating how long they will live. Your report will also show how much your beneficiaries would receive if you passed away or became disabled.

Conclusion

Social Security is one of the most successful social programs we have ever created in America. It provides basic retirement income benefits to widows and children when a parent dies, and provides disability benefits to people who are unable to work. We should proudly work to ensure that future generations are guaranteed the same benefits we and our parents have been afforded. Reckless policy proposals could undermine the fabric of this incredible program that has provided a strong foundation for retirement with dignity in our country.

You can find Diane and all the other #BlueAmericaBetterHouse -endorsed candidates on our BetterHouse24 ActBlue page.

Thanks for always doing what you can to help make this a better world,

Howie, for the entire Blue America team

Comments